45l tax credit requirements

In the past the IRS issued this Notice Section 4 Part 3 that says the 45L Tax Credit is only applicable to buildings that are 3 stories or less. Starting in 2023 and extending.

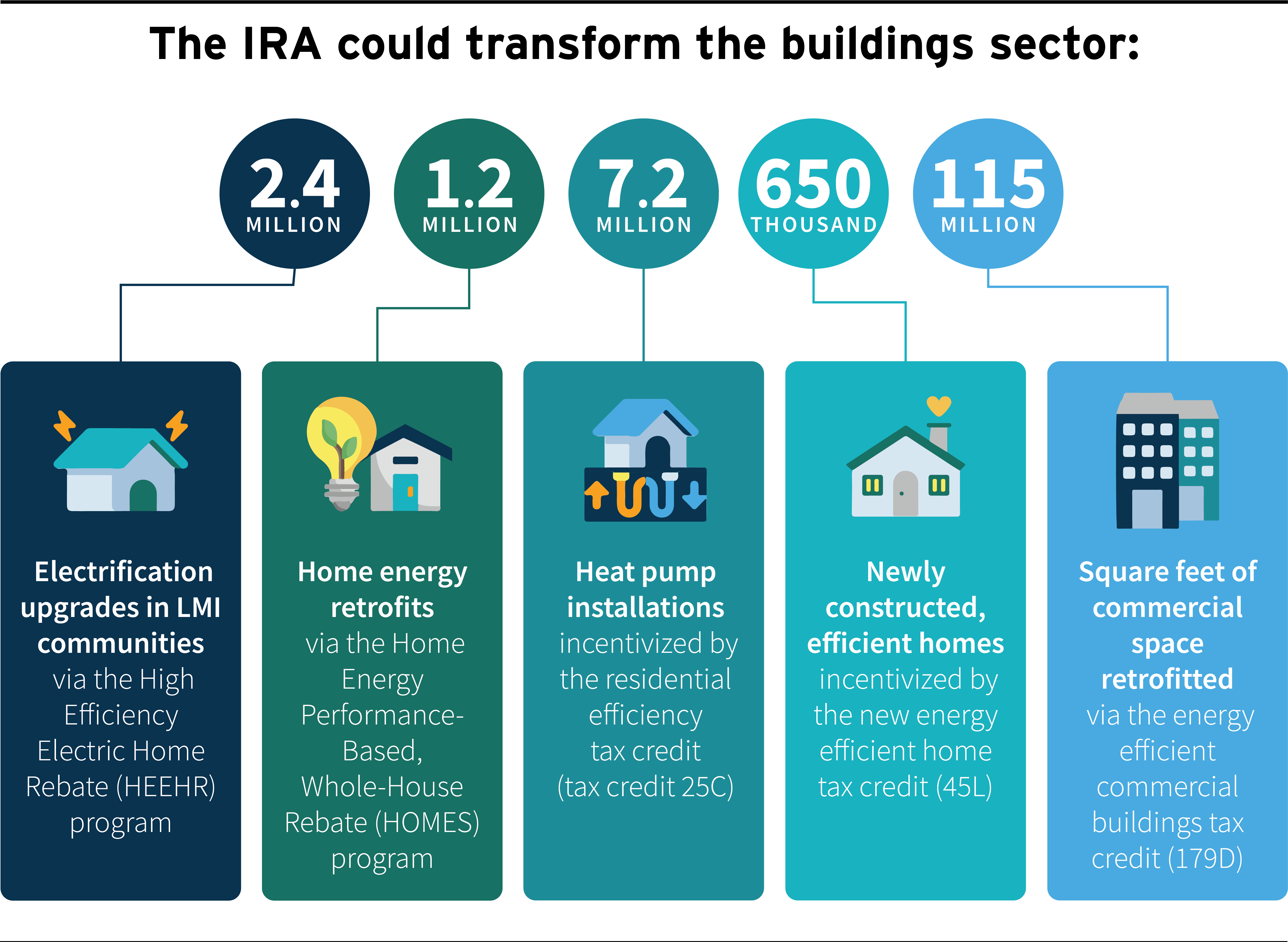

Inflation Reduction Act Signed Into Law Extends And Expands Energy Efficient Tax Incentives Capstan Tax Strategies

Single-Family New Homes -.

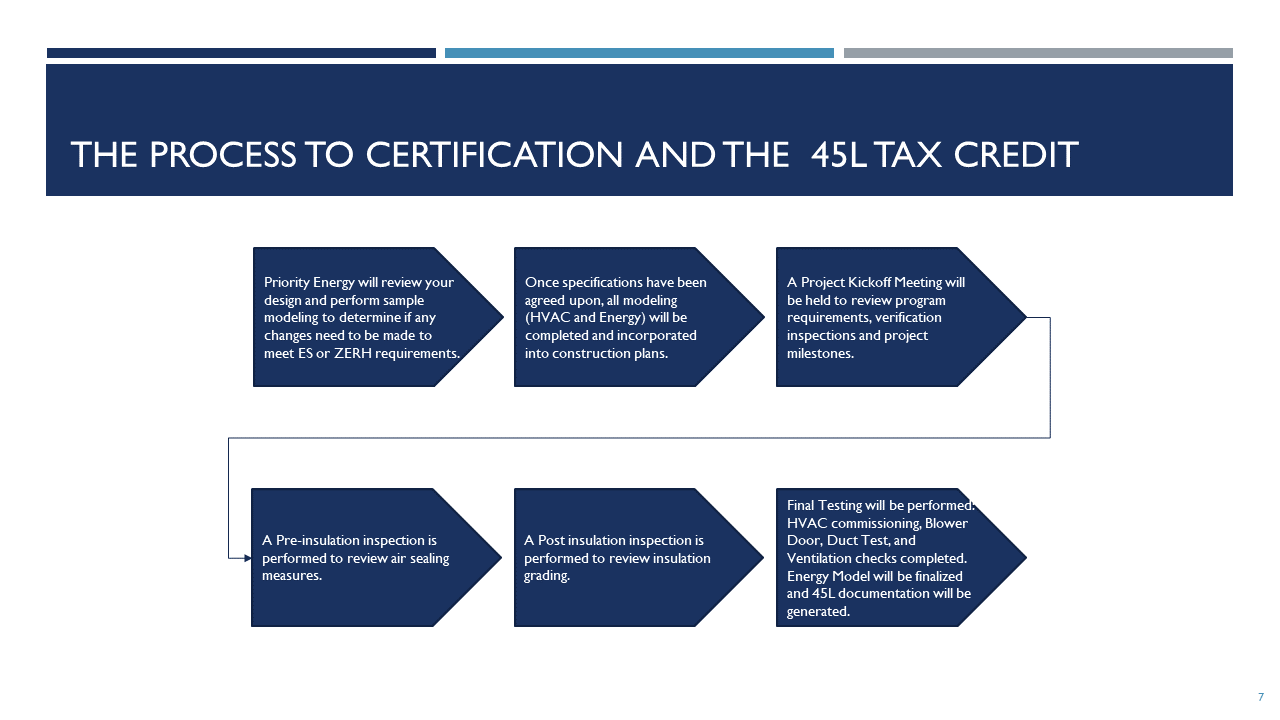

. Code 45L - New energy efficient home credit. Corporations provide equity to build the projects in return for the tax credits. The 45L Federal Tax Credit Incentives- Updated Requirements for 2023 Single-Family New Homes - 2500 for homes that meet ENERGY STAR v31 certification.

We are not sure if this Notice. The 45L Tax Credit is a Federal Tax Credit worth 2000 per dwelling unit that rewards multifamily developers investors and homebuilders that develop energy efficient. REQUIREMENTS Single Family Homes Benefits and Requirements 2500 tax credit for single family homes certified as ENERGY STAR Single.

Originally expired at the end of 2021 45L tax credits have been retroactively extended under the same program through the end of 2022. The program also covers HUD Handbook 43503 guidance that pertains to Low-Income Housing Tax Credit LIHTC properties. The 45L Credit which currently only applies to homes leased or sold prior to January 1 2022 provides a 2000 dollar per home tax credit for homes that meet certain energy efficiency.

We recommend that any apartment or condominium project developed new construction or rehabilitation within the past four years be evaluated for the 45L tax credit. You can still claim the existing Section 45L tax credit through 2022 and also in prior years by amending any open year tax returns typically three years prior. Please visit the Database of State Incentives for Renewables Efficiency website DSIRE for the latest state and federal.

CTCAC allocates federal and state tax credits to the developers of these projects. If you have constructed or substantially renovated an apartment condominium or single family residence development of 20 units or more since 2006 you could be eligible for the Section. Learn about the 45L Credit for 2022 and prior.

Acquired by a person from such eligible contractor for use as a residence during the taxable year. TCAC verifies that the. Section 45L requirements for a new energy-efficient home Before a property can be evaluated in terms of its energy efficiency it must meet certain requirements to be eligible.

Tax Credits Rebates Savings. If you are responsible for tax credit properties.

45l Tax Credit Multifamily Guide For More Money Back Southern Energy Management

45l Tax Credit Energy Efficient Credit Richmond Cpa Firm

What Is The 45l Tax Credit Get 2k Per Dwelling Unit

45l Tax Credit Energy Efficient Home Tax Credit Tax Point Advisors

45l Energy Efficient Tax Credits Engineered Tax Services

Section 45l Tax Credit Rewards Developers Of Energy Efficient Homes Our Insights Plante Moran

Ira Seeks To Transform The Building Sector

45l Federal Builder Tax Credit

Extended 179d Energy Efficient Commercial Building Deduction And 45l Energy Efficient Home Credit Ics Tax Llc

Section 45l Homebuilders Claim 2021 Section 45l Atlanta Cpa

Section 45l Tax Credits The Most Overlooked Tax Credit For Residential Developers Krost

Proposed Coronavirus Relief Legislation Titled Consolidated Appropriations Act 2021 Would Extend 179d And 45l Energy Efficiency Incentives Ics Tax Llc

2021 Available Tax Incentives For Energy Efficiency Cova Green Homes

Inflation Reduction Act Impacts Major Changes To 45l Tax Credit 179d Deduction Doeren Mayhew Cpas

The Inflation Reduction Act Impact On 45l Tax Credit Ics Tax Llc