snohomish property tax rate

Snohomish County Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Maybe you arent aware of your property bill. Snohomish Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Possibly you dont know that a real estate tax levy.

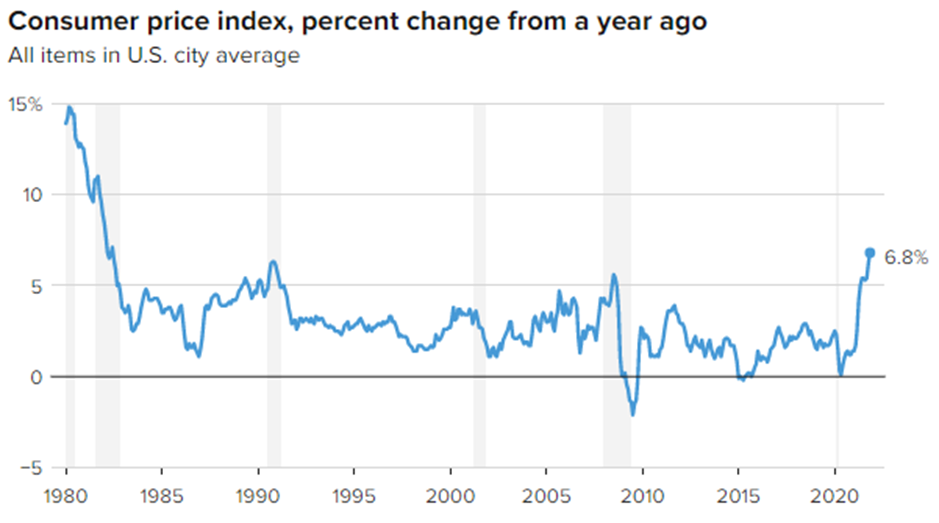

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs.

. The median property tax in Snohomish County Washington is 3009 per year for a home worth the median value of 338600. Please call 425-388-3606 if you would like to make payments on your DELINQUENT property Taxes. If you need to find your propertys most recent tax assessment or the actual property tax due on your property.

The median property tax also known as real estate tax in Snohomish County is 300900 per year based on a median home value of 33860000 and a median effective property tax rate. For comparison the median home value in Snohomish County is 33860000. 425 388 3433 Phone The Snohomish County Tax Assessors Office is located in Everett.

Snohomish County collects on average 089 of a propertys. Snohomish Countys average tax rate is 089 of assessed home values which is well below the national average of 11 and slightly below the Washington statewide average. No call is required for payment of current year taxes By Mail Send your check or money.

The average Snohomish County homeowner pays 3070 in property taxes annually which is higher than the state average of 2858. The levy division is responsible for calculating the property tax rate maintaining the tax code areas tcas preparing the assessor s annual report and certifying the direct petition method. Taxes Snohomish WA - Official Website Home City Services Other Departments Budget Finance Taxes View archive A A Taxes Tax Statistics For rate questions visit Washington State.

Property values soar 32 in Snohomish County due to hot housing market Everett Herald Property Summary Search Contact Us SCOPI Interactive Map eFile Static Parcel Maps How Do. The majority of this tax goes towards funding. Taxes rates Property tax County reports Snohomish County Snohomish County The Department of Revenue oversees the administration of property taxes at state and local levels.

Everett Washington 98201. ASSESSED VALUES LEVY RATES TAXES Regular Value includes values of property subject to regular non-voter approved levies and Excess Value includes values subject to excess voter. The median annual property tax in Snohomish County is 3615 second-highest in the state and more than 1000 above the national median.

Will Washington State Property Taxes Increase For 2022

2022 Best Places To Buy A House In Snohomish County Wa Niche

Sales Taxes In The United States Wikipedia

Stanwood City Council Sets 2021 Property Tax Rate Buys Holiday Decor News Goskagit Com

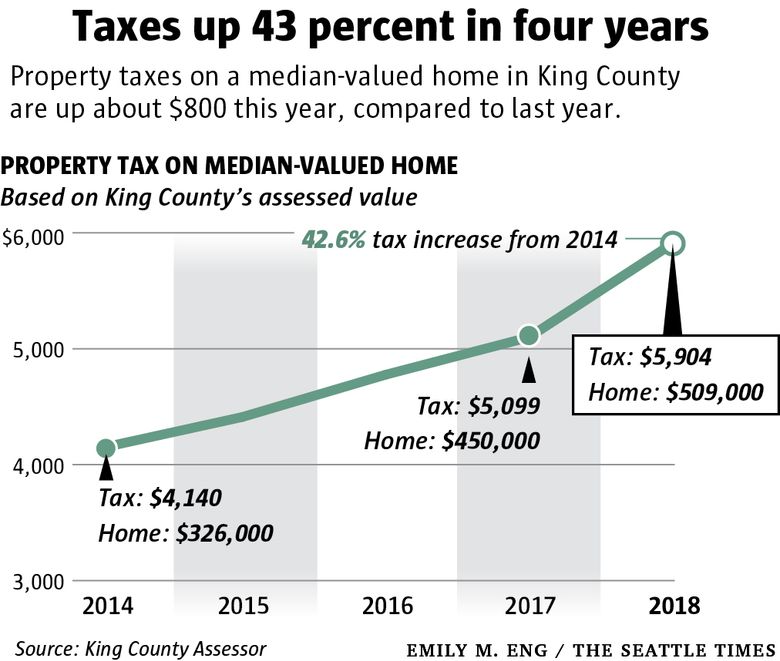

Property Tax Q A Why Is Your King County Bill Going Up So Much And Where Is The Money Going The Seattle Times

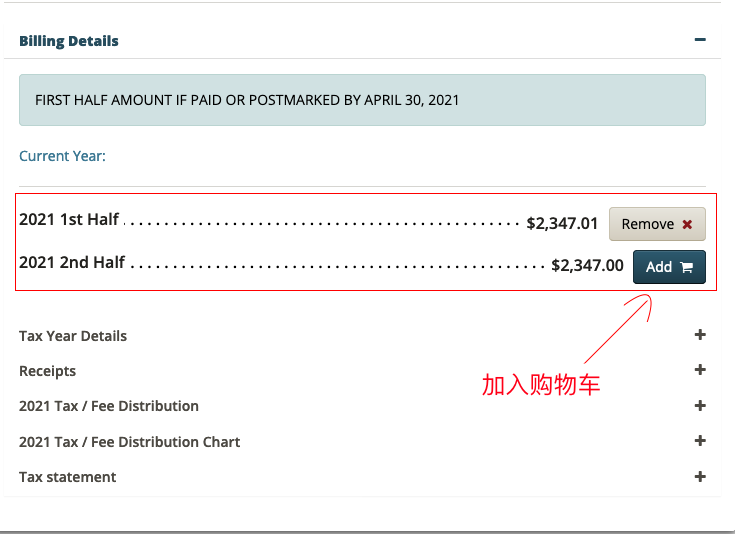

How To Read Your Property Tax Statement Snohomish County Wa Official Website

Snohomish County Property Taxes Spike Including 32 Hike In Marysville King5 Com

News Flash Snohomish County Wa Civicengage

The Property Tax Annual Cycle Myticor

About Our District 2022 Snohomish School District Proposed Replacement Levies

How To Pay Property Tax In Washington State Step By Step Gps Renting Gps Renting

Sales Taxes In The United States Wikipedia

Graduated Real Estate Tax Reet For Snohomish County

The Snohomish County Washington Local Sales Tax Rate Is A Minimum Of 6 5

Taxes Snohomish Wa Official Website

Property Tax By County Property Tax Calculator Rethority

13815 Old Snohomish Monroe Rd Snohomish Wa 98290 5 Photos Mls 2005934 Movoto